Why did I decide to work in a company?

My app businesses are running well and stable. But now is the right time for me to work in a company.

Optimize My Wealth

Currently my app businesses are running on autopilot and bringing in passive income every month.

Algotrading

After completing my algotrading project, I started considering my next steps. The advantage of my algotrading system is that it allows me to grow my wealth in percentage, not absolute amount.

There are 2 variables I can tune to increase my total gains from algotrading. These 2 variables are account balance and time. Working in company fits in perfectly as I can increase the balance from monthly salary and let it compound overtime while working.

Why not build another startup?

It takes a long time for a new startup to start making profit. And most startups don't make profit before it gets shut down.

Comparing it to working for a company where I get salary from first month. Couple with compounding it, working for a company is no brainer.

There's always time to build a startup. But do it when you're rich, not poor, especially when you're not young anymore.

CPF & Medisave

Because I have been a founder for my whole life, I didn't contribute much to my CPF. Thus, I don't have much funds in my pension balance. For cases like housing, I already have plans. It's the healthcare costs that worries me.

Medisave

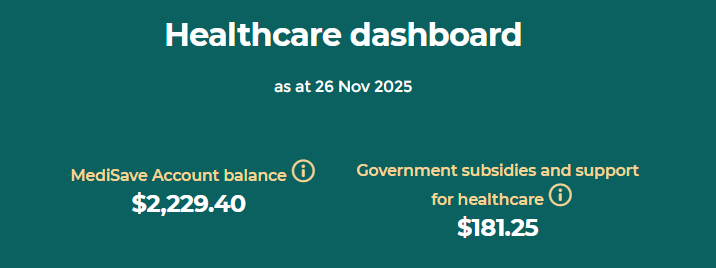

My Medisave initially had $4k+. Then last month I went for wisdom tooth surgery and the whole procedure costs almost $2k.

Now my Medisave is now left with $2k+. This balance will only cover the premiums for MediShield Life within the next few years.

The thought of forking out future medical bills out of my own pocket scares me. Even when I was paying $2k for the wisdom tooth surgery from my Medisave, I could already feel the pain.

Healthcare Costs

Healthcare is only going to get more expensive. Not only because of age, but also because of the global healthcare trend. This means that even if I have health insurance covered, the premiums is only going to be more expensive. That's why I feel there's a need to bulk up my Medisave balance.

Employer Contribution

Compared to many other countries, Singapore have good pension scheme as safeguard to ensure our citizens have money when we're old. When I work for company in SG, I contribute 20% and my employer contribute 17% of my salary to my CPF.

With a good monthly salary, I should be able to have sufficient top-ups to my CPF to ensure there's a safety net cushion for the future.